Are You Ready for Business Funding?

Terrance Wilson Business Loans, Entrepreneur Life Leave a Comment on Are You Ready for Business Funding?

Just the other day, I was watching an old episode of “Martin” and found myself cracking up at a business idea conceived by Cole, one of the characters. He came up with a unique venture called “Rent-a-Spoon”. The premise? Soup is free, but you have to rent the spoon to eat it. Absurd, right? However, amid the laughter, I found an intriguing parallel between this fictional scenario and the real-world journey of an entrepreneur. As a loan broker, I’ve noticed a common tendency among aspiring business owners to rush towards securing funding without having a fully fleshed-out and tested business […]

Scammy Tenants 101: An Investor’s Guide to Spotting, and Avoiding Shady Renters

Dee Lewis Real Estate Investing real estate investingLeave a Comment on Scammy Tenants 101: An Investor’s Guide to Spotting, and Avoiding Shady Renters

Scammy tenants are just as bad as scammy contractors. Have you ever heard of Mark Newton of New Jersey? If you have not, picture this: a smooth-talking tenant with an uncanny knack for living rent-free, exploiting legal loopholes, and leaving a trail of havoc in his wake. Mark was no run-of-the-mill rent-dodger. His modus operandi? Trash the house, overstay without paying a dime, leaving landlords grappling with the mortgage. A property investor’s nightmare, right? So let’s roll up our sleeves and delve into this tale of caution, uncovering practical tips to help you avoid your very own Mark Newton encounter. […]

How to Spot and Avoid Scammy Contractors in Real Estate Investing

Dee Lewis Real Estate Investing contractors, real estate investingLeave a Comment on How to Spot and Avoid Scammy Contractors in Real Estate Investing

In the world of real estate investing, countless opportunities await. But beware! Like seashells on a beach, there’s an abundance of deceitful contractors ready to ensnare the unsuspecting. Avoiding a misstep is crucial, as the wrong choice can spell trouble for your investments. While the thought of purchasing properties and watching your portfolio grow is exhilarating, it’s crucial to remember that, like any industry, real estate has its share of hazards. One potential pitfall? Fraudulent contractors. Scam artists disguised as contractors can be found lurking in the shadows, ready to exploit unsuspecting investors. Often, these swindlers might claim to have […]

5 Bad Money Habits that Can Stop Business Growth

Dee Lewis Entrepreneur Life Leave a Comment on 5 Bad Money Habits that Can Stop Business Growth

Running a successful business is no easy feat. It requires a combination of dedication, hard work, and, of course, smart money management. However, many business owners unknowingly fall into bad money habits that can hinder their growth and potential. In this blog post, we’ll explore five common mistakes entrepreneurs make and provide practical tips on how to steer clear of them. So, let’s dive in and ensure your business is on the path to success! #1 Neglecting Cash Flow Strategy Cash flow management is the lifeblood of any business. Failing to plan and monitor your cash flow can have detrimental […]

Keep Your Cool: The Importance Of Staying Calm During Real Estate Closings

Dee Lewis Real Estate Investing, Real Estate Investor Loans real estate investing, real estate loansLeave a Comment on Keep Your Cool: The Importance Of Staying Calm During Real Estate Closings

When investing in real estate, whether you’re a seasoned veteran or a new player in the game, closing can be a nerve-wracking experience. With so many moving parts, it’s easy to get overwhelmed and succumb to the stress of the situation. But staying calm and level-headed during closing is crucial. In this blog post, we’ll explore why a real estate investor should stay cool during a closing and what to expect. You Set the Tone The first reason why staying calm is essential during closing is that your behavior will set the tone for the entire process. If you’re frazzled […]

How Private Loans Can Benefit Real Estate Investors with Low Credit Scores

Dee Lewis Real Estate Investing, Real Estate Investor Loans real estate investing, real estate loansLeave a Comment on How Private Loans Can Benefit Real Estate Investors with Low Credit Scores

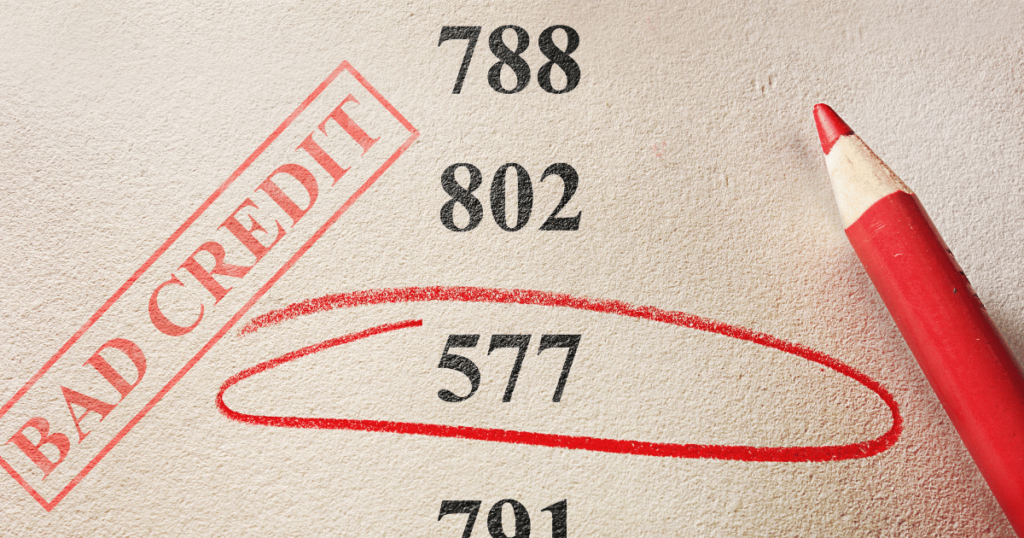

Low Credit Scores & Competitive Loans At The Funding Clinic, we always try to find a real estate investor the best deal with the least amount of fees. However, some Real Estate Investors may have low credit scores that don’t allow them to get the most competitive loan. If time allows, one of the first things we suggest is to enter our DIY Credit Repair Academy to improve their scores. Improving credit scores can save investors thousands of dollars in high fees and interest rates, while also opening up access to better financing options from traditional lenders. Private Loans for […]

Real Estate: Dry Closing vs. Wet Closing – What You Need to Know

Dee Lewis Real Estate Investing real estate investing, real estate loansLeave a Comment on Real Estate: Dry Closing vs. Wet Closing – What You Need to Know

One question that frequently arises during the loan closing process is the distinction between a wet closing and a dry closing. It’s a topic that can leave some clients feeling a bit parched, especially when they discover that some lenders only offer dry closings. Wet Closings In a wet closing, everything is finalized in a single swoop, while the ink is still wet on the paper. It’s like a whirlwind romance, where you fall head over heels and tie the knot all in the same day. Dry Closings On the other hand, a dry closing is more like a slow […]

Why a Quitclaim Deed Is Not Enough

Dee Lewis Real Estate Investing real estate investingLeave a Comment on Why a Quitclaim Deed Is Not Enough

The Importance of Title Insurance for Property Transfers In This Post: Types of Deeds and Buyer Protection If you’re thinking about transferring ownership of a property within your family using a quitclaim deed, there are a few things you need to keep in mind to ensure your loved ones are fully protected General Warranty Deeds: Your Highest Protection First off, it’s important to understand that not all types of deeds offer the same level of buyer protection. General warranty deeds offer the highest level of protection by guaranteeing that the grantor has the legal right to transfer ownership and that […]

How Small Businesses Can Avoid Failure

Terrance Wilson Business Loans, Entrepreneur Life, Financing Leave a Comment on How Small Businesses Can Avoid Failure

In This Post: Small businesses often encounter difficulty when trying to stay afloat and remain successful. While there are no guarantees that any business will stay in operation for the long haul, there are certain steps that can be taken to increase the likelihood of success. Here is an overview of some common reasons why small businesses fail, along with advice on how these issues can be avoided. Inadequate Capitalization/Funding Sources One of the most common causes for a small business to fail is inadequate capitalization or funding sources. Without sufficient financial resources to cover startup costs, rent payments and […]

TOP 5 REASONS LOANS DON’T CLOSE

Dee Lewis Real Estate Investing, Real Estate Investor Loans, Uncategorized Leave a Comment on TOP 5 REASONS LOANS DON’T CLOSE

You’ve put in countless hours of research, shopping around and preparing documents only to learn that your loan isn’t going to close. As a real estate investor, the last thing you want is for your mortgage loan to fall through. Knowing the most common reasons some loans don’t close is the first step in making sure yours does. Let’s take a look at what real estate investors need to know in order to make sure their loan closes without a hitch. The top 5 most common reasons for mortgage loans falling through are: insufficient funds, credit score problems, income verification […]

Why Accepting Cash Only is Hurting Your Business

Dee Lewis Business Loans, Entrepreneur Life Leave a Comment on Why Accepting Cash Only is Hurting Your Business

In This Post A Cash Man’s Blues “Hey, can I send you this money so you can pay the plumber?” I asked my long-term tenant. “Of course,” she texted back. Asking her to pay the plumber was far from ideal, but with me not living in that city and the plumber only accepting cash or checks, it was necessary. I’m grateful for our good relationship and the trust that exists between us; it makes dealing with these types of situations much easier. Things would have been more convenient if the damn plumber accepted other forms of payment instead of just […]

DSCR and It’s Impact on Business Loans: Is Your Math ‘Mathing’?

Dee Lewis Business Loans business loans, real estate loansLeave a Comment on DSCR and It’s Impact on Business Loans: Is Your Math ‘Mathing’?

In This Post The lowdown on DSCR: What it is and why it matters for your business’s health DSCR. At first glance, it sounds like something you’d find in a medical dictionary, not a financial one. But, let us tell you, it’s just as important for your business’ health as a regular check-up is for your own. Debt service is the monthly payment you make on a loan. This includes the principal and interest payments due each month and can also include other costs, such as insurance premiums and taxes. DSCR stands for Debt Service Coverage Ratio, and it’s a […]

Car Loan Showdown: Bank vs. Dealership

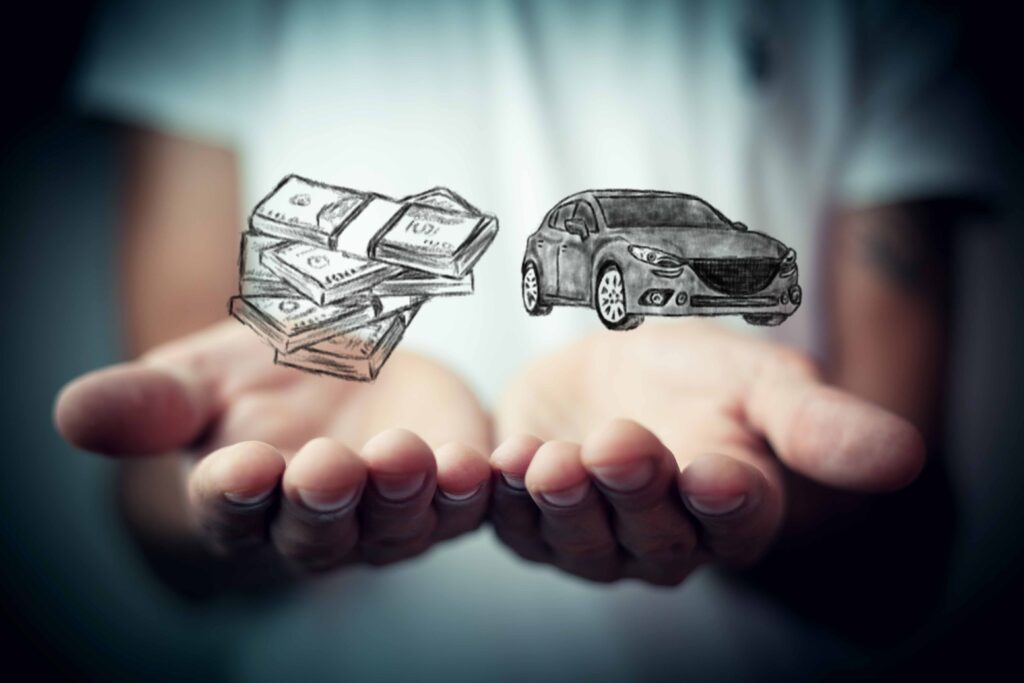

Dee Lewis Credit Repair, Financing car-shoppingLeave a Comment on Car Loan Showdown: Bank vs. Dealership

So, you’re in the market for a new car and you’re wondering if it’s better to shop for a car and secure financing all in one place at the dealership or get a car loan from a bank or credit union. Well, let me tell you, the answer may surprise you. In This Post ADVANTAGES OF GETTING A CAR LOAN AT BANK OR CREDIT UNION You see, banks and credit unions may offer you the ability to apply for pre-approval or outright approve you, which turns you into a cash buyer at dealerships. This can make it easier to compare […]

5 Reasons Inflation is Good for Real Estate Investing

Dee Lewis Real Estate Investing inflationLeave a Comment on 5 Reasons Inflation is Good for Real Estate Investing

IN THIS POST Inflation got you worried that your property values will take a nosedive? Don’t hit the panic button just yet. In this article, we’ll put on our Sherlock Holmes caps and dig into the mystery of whether inflation and property values are truly mortal enemies. We’ll explore the reasoning behind the naysayers’ claims and separate fact from fiction, so you can make investment decisions with confidence, not fear. So, grab a cup of tea, and let’s start solving this mystery together and you’ll discover 5 reasons inflation is good for real estate investing. Reason #1 Inflation is like […]

Is Inflation Good or Bad for Real Estate Investing?

Dee Lewis Real Estate Investing inflationLeave a Comment on Is Inflation Good or Bad for Real Estate Investing?

In This Post First came the Pandemic…then came Real Estate and Inflation. The jury may still be out on whether we can officially call these times a recession, but inflation has definitely made its presence known, and it has had a significant impact on the economy. But what does this mean for real estate investors? After all, inflation affects the prices of goods and services, and housing and materials are no exception. So is inflation good or bad for real estate investing? Let’s take a closer look at this important question. How Inflation Affects Property Owners We typically see inflation […]